Semiconductors

Isatis Investment – Technology

A fund specialized in technology for those seeking differentiated long-term growth.

A team with more than 30 years of experience in the technology sector, combining a track record as founders and executives of successful companies with extensive investment experience in the public markets. Thanks to this long-standing background, we can say that, unlike other funds or generalist firms, at Isatis we are true technology experts. We combine the most rigorous financial analysis with a deep understanding of products and technology, aiming to identify competitive advantages, business dynamics, and structural trends ahead of the market.

Dynamic investment universe of over 100 companies,

divided into 10 clusters:

Cloud Platforms

Cibersecurity

Observability

ERP

Customer Experience (CX)

Fintech

Payment Methods

IT services

Digital Adversiting

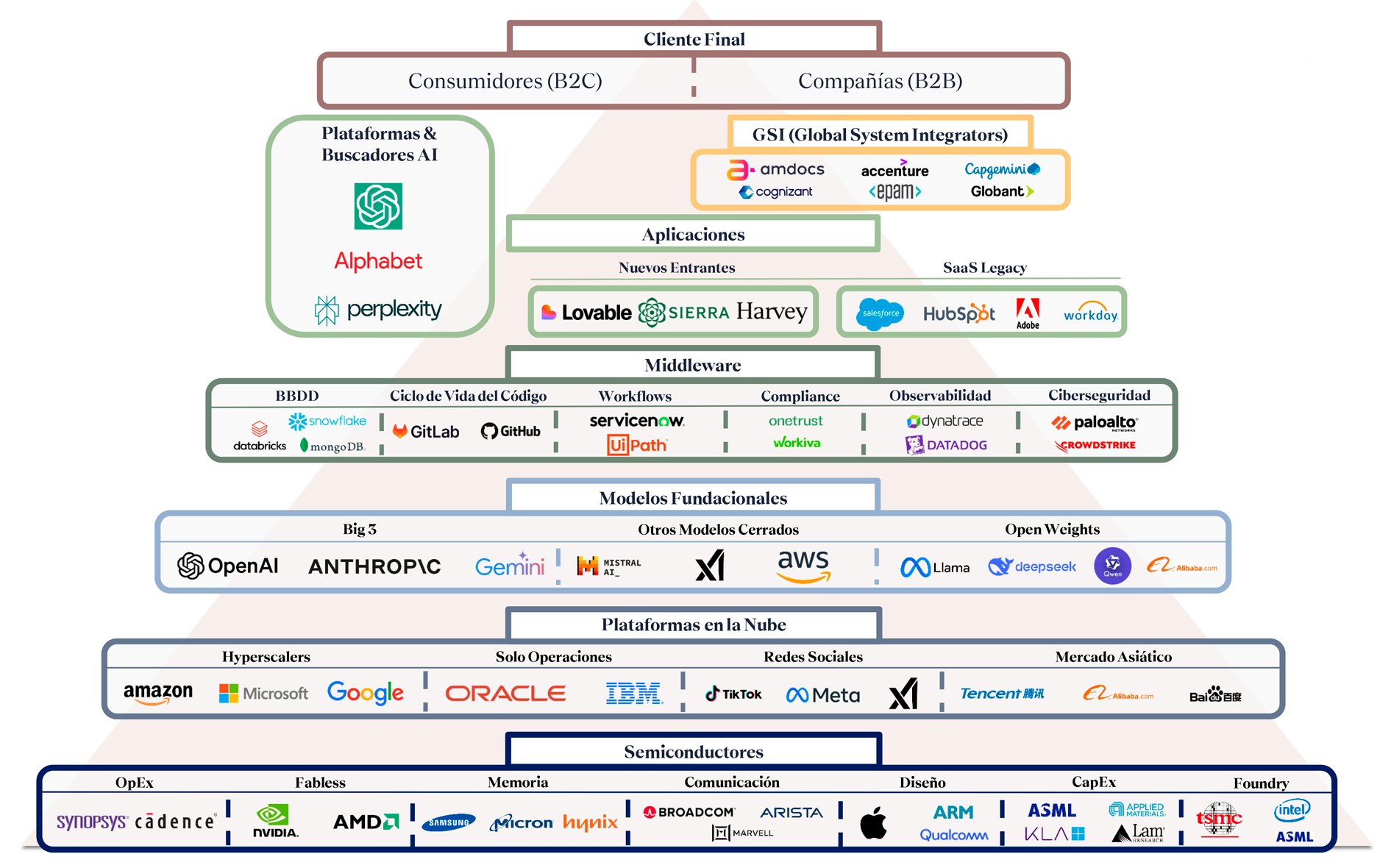

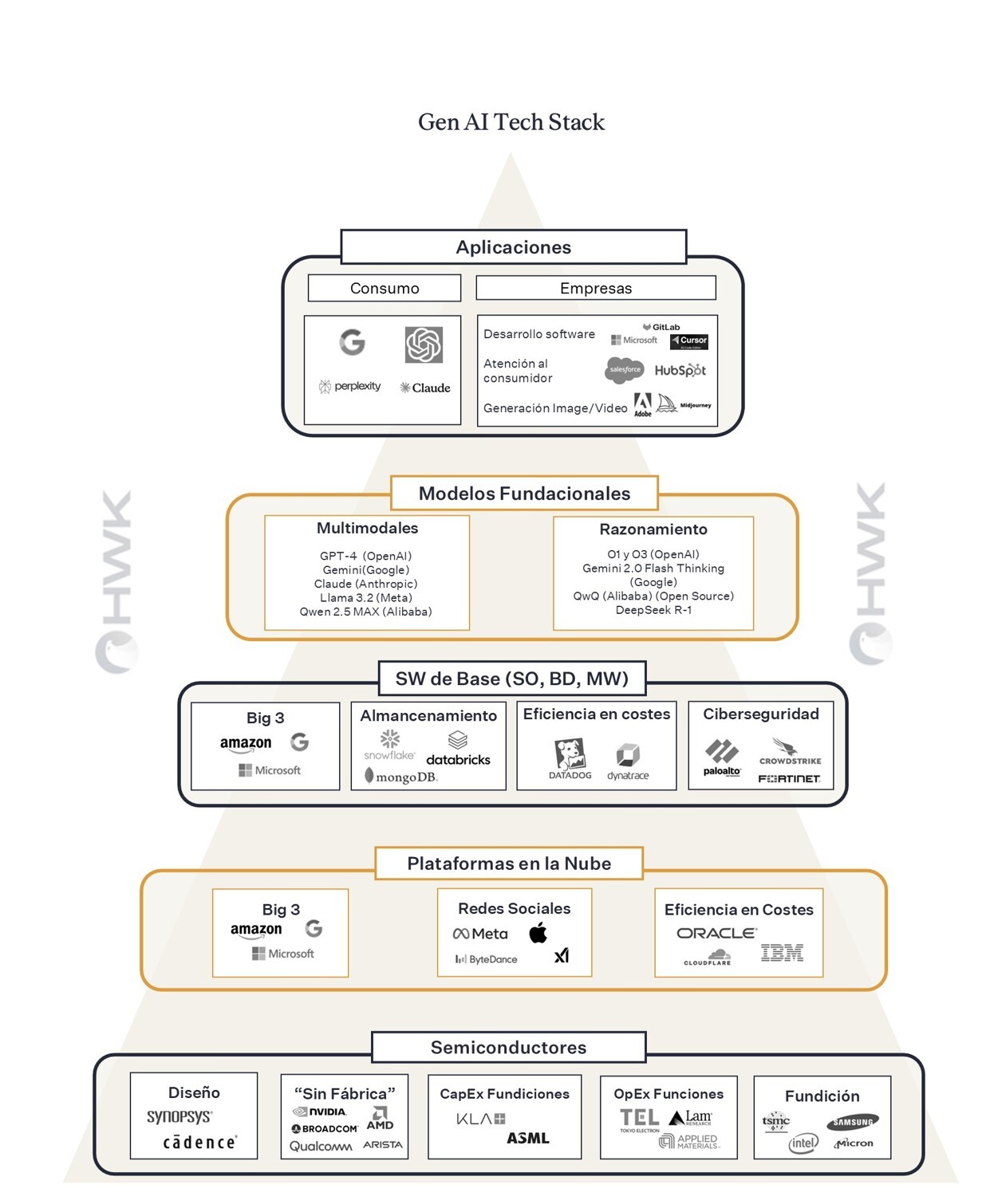

This allows us to provide comprehensive coverage of all layers of the technology stack and the interactions between them. Thanks to this, we can identify both established leaders and emerging winners in the niches with the best growth prospects, capitalizing on opportunities arising not only from trends specific to each cluster but also, more broadly, from the disruption driven by Artificial Intelligence.

This allows us to provide comprehensive coverage of all layers of the technology stack and the interactions between them. Thanks to this, we can identify both established leaders and emerging winners in the niches with the best growth prospects, capitalizing on opportunities arising not only from trends specific to each cluster but also, more broadly, from the disruption driven by Artificial Intelligence.

The impact of generative artificial intelligence:

GenAI is impacting and transforming the technology stack, but not equally or at the same pace across all layers. As technology experts, our role is precisely to:

Identify where these transformations are taking place.

Assess the associated monetisation dynamics.

Position ourselves in those companies that best capture this value at each stage of the adoption cycle.

This allows us to provide comprehensive coverage of all layers of the technology stack and the interactions between them. Thanks to this, we can identify both established leaders and emerging winners in the niches with the best growth prospects, capitalizing on opportunities arising not only from trends specific to each cluster but also, more broadly, from the disruption driven by Artificial Intelligence.

The impact of generative artificial intellegence

GenAI is impacting and transforming the technology stack, but not equally or at the same pace across all layers. As technology experts, our role is precisely to:

Identify where these transformations are taking place.

Access the associated monetisation dynamics.

Position ourselves in those companies that best capture this value at each stage of the adoption cycle.

In developed societies, which already possess substantial accumulated capital, productivity improvements stem primarily from technological progress. Therefore, investing in technology is investing in the engine of productivity, economic growth, progress, and the well-being of modern societies.

In the digital era, technology companies capture an increasing share of global value added thanks to innovation, network effects, scalability, and market dominance. They are not mere isolated solutions but have become critical infrastructure for businesses and consumers. In this context, industry leaders, supported by hard-to-replicate competitive advantages, translate this position into sustained growth and margins above those of other industries.

Investing in technology means investing in the innovative businesses that shape the future, ensuring exposure to the transformative trends that will define the coming decades of growth.

On the MiFID scale, our risk rating is 5/7, mainly because we invest in technology equities.

Like any equity fund, Isatis has high volatility, so it is only suitable for minimum investment horizons of 3 to 5 years or more. However, due to our investment style, volatility has historically tended to be lower than that of the main benchmark indices.

Position Size - Concentrated Portfolio

| Weight of a holding in the portfolio (%) | % Wallet |

| 2% | 35% |

| 4-5% | 35% |

| 5%<X<10% | 30% |

Company size – Sesgp towards midcaps vs index focused on Mag7

| Company type | Market Capitalization ($B) | % Wallet |

| Megacap | > $300B | 15% |

| Big Cap | $10B < X < $300B | 70% |

| Mid-small | < $10B | 15% |

More than a fund: your trusted expert in tech investing

Acceso a un equipo con más de 30 años de experiencia en tecnología

Distribución de carta mensual sobre la situación del fondo y las novedades más relevantes de las compañías que cubrimos.

Realización de webinars mensuales (con posibilidad de interactuar y realizar preguntas) sobre la situación del sector tecnológico, para que estés al día de las últimas novedades y tendencias.

Access to a team with over 30 years of experience in technology.

Monthly letter distribution covering the fund’s status and the most relevant updates from the companies we cover.

Monthly webinars (with the opportunity to interact and ask questions) on the state of the technology sector, keeping you up to date with the latest news and trends.

Access to a team with over 30 years of experience in technology

Monthly letter distribution covering the fund’s status and the most relevant updates from the companies we cover.

Monthly webinars (with the opportunity to interact and ask questions) on the state of the technology sector, keeping you up to date with the latest news and trends.

Continuation of the strong investment cycle in semiconductors and cloud infrastructure, driven by the demand for computing and storage for AI applications.

Gradual adoption and early signs of monetization of Generative Artificial Intelligence solutions, with varying impacts across different layers of the technology stack.

Impact of the new political cycle in the U.S. under President Donald Trump: initial tariff noise, but generally lower taxes and regulatory easing for tech companies.

A low-interest-rate environment without recession, which historically has favored valuations, especially for software companies.

For further information, please contact us at info@hwk.es .

Consult information about the fund

HWK. © 2025. All rights reserved

*Investments made by the sponsoring partners that will be contributed to SCR I*

-eng.jpg?width=1920&height=412&name=Banner-cta-(MYINVESTOR)-eng.jpg)